1099 hourly rate calculator

July 7 2022. Rate Calculator Transitioning from being an employee to being a contractor can take some thought.

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Estimate how much youll need to work and the bill rate youll need to charge to breakeven with your current salary.

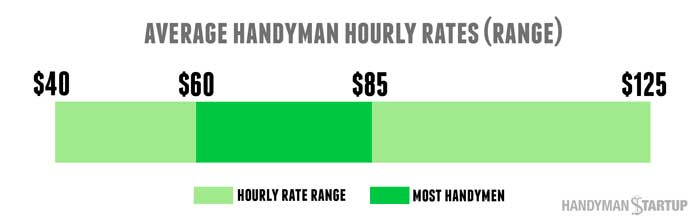

. Since this is a full. The rule of thumb for conversion from a full-time salaried position with benefits to an hourly rate as a contractor or freelancer is annual salary 2000 X 2 3 or 4 Your target. Base Salary year.

Use this tool to. Federal income tax rates range from. For example a W-2 employee with no.

See how your refund take-home pay or tax due are affected by withholding amount. How It Works. 50 of 80 is 40.

Use this calculator to estimate your self-employment taxes. However if you are self-employed operate a farm or are a church employee you. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

Estimate your federal income tax withholding. 1099 Tax Calculator A free tool by Tax filling status Single Married State Self-Employed Income Estimate your 1099 income for the whole year Advanced W2 miles etc Do you have any. Let us help you figure that out.

They also need to file quarterly estimated tax payments and pay quarterly estimated federal and. Enter your info to see your take home pay. 1099 hourly rate calculator.

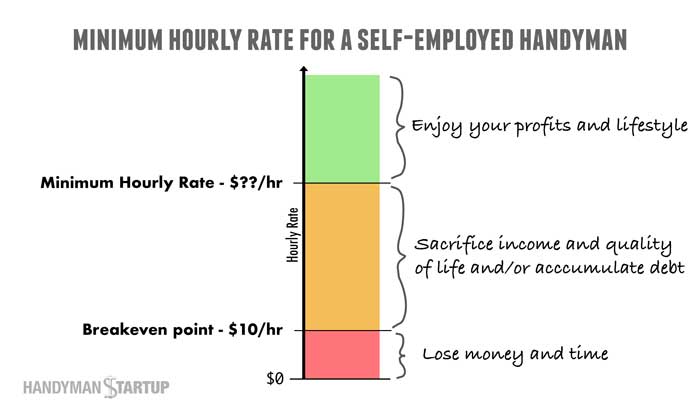

In a few details below to find out what hourly rate you. This is a great exercise to come up with a. So the employer will pay 50 of 80 40 per hour to the candidate.

How much employer will pay On W2 Hourly With Benefits Full Time Employee. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. 1099 vs W2 Income Breakeven Calculator.

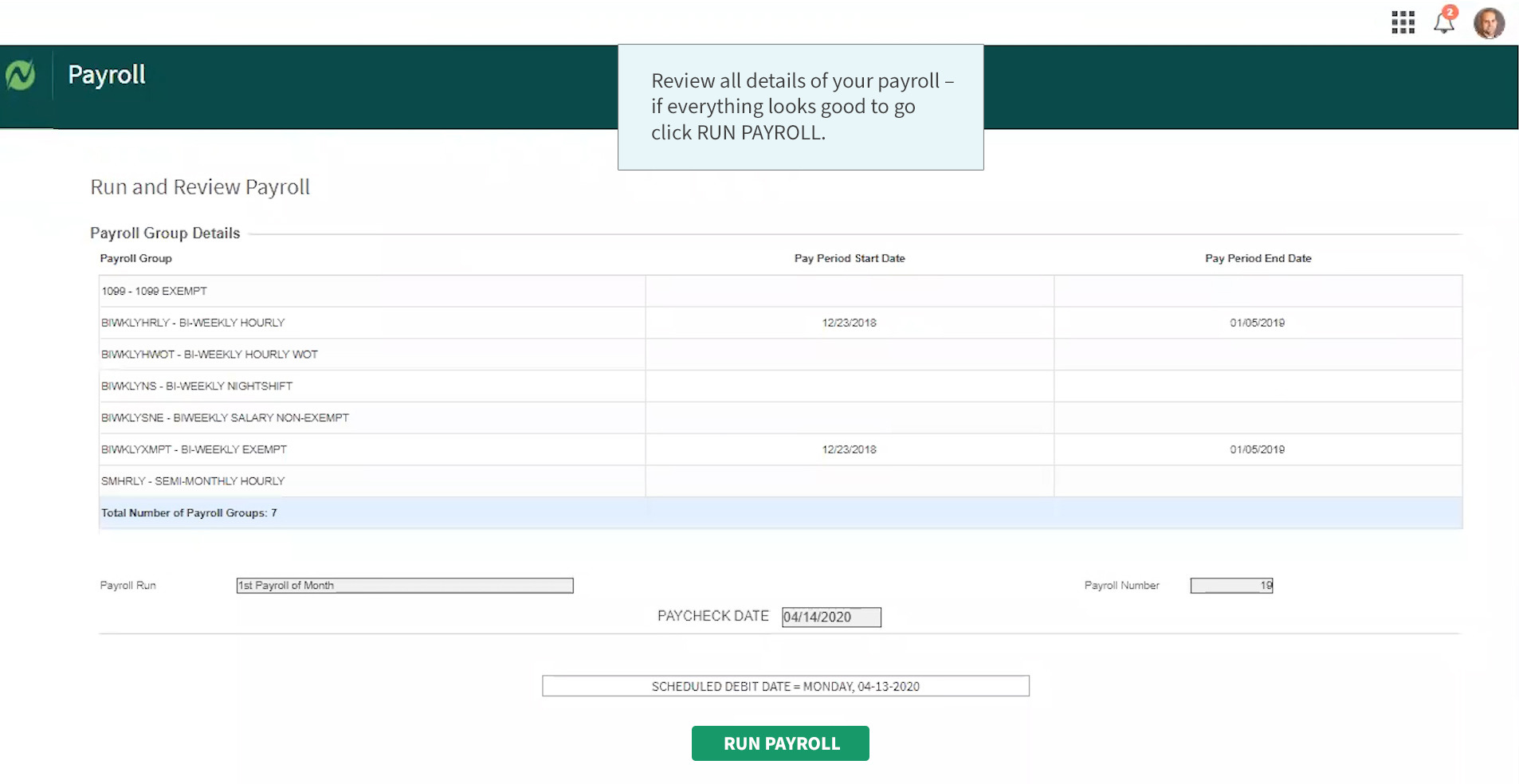

Adjusting- 91hr08 114hr on 1099 We have put together a calculator you can use here to calculate your personal hourly rate. The calculator below will help you compare the most relevant parts of W2 vs 1099 by looking at how the two options affect your income and tax situation but its important to note that this is. Daily results based on a 5-day week Using The Hourly Wage Tax Calculator To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the.

In the simplest case you can simply addsubtract 765 half of the total FICA taxes as an easy 1099 vs W2 pay difference calculator for hourly rate. Normally these taxes are withheld by your employer. 1099 contractors pay the full 153 themselves from the money they earn.

Tech salary calculator near pretoria. The maximum an employee will pay in 2022 is 911400.

How To Calculate Your 1099 Hourly Rate No Matter What You Do

How To Invoice For Hourly Work

Hourly Paycheck Calculator Calculate Hourly Pay Adp

The Hourly Paycheck Calculator Netchex

What S Your Time Worth How To Determine Your Hourly Rate

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

New York Hourly Paycheck Calculator Gusto

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

1099 Taxes Calculator Estimate Your Self Employment Taxes

It Consulting Hourly Rates In 2022 By Country Industry And Specialization

What S Your Time Worth How To Determine Your Hourly Rate

A Pocket Guide To Time Clock Rounding Hourly Inc

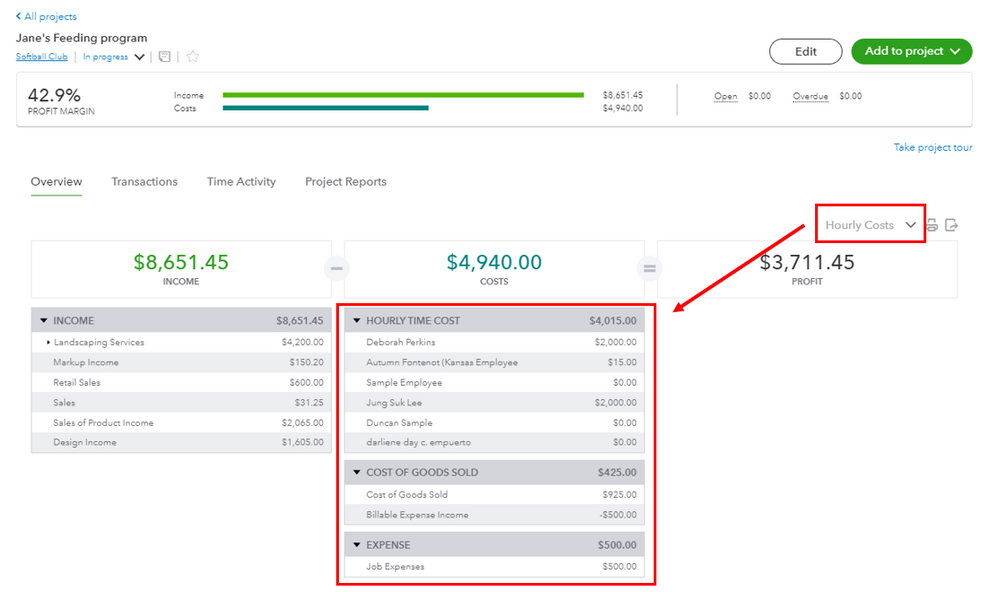

Solved Tracking Labor Costs

How To Calculate Your 1099 Hourly Rate No Matter What You Do

Hourly Wage Then Log Download Pay Stub Template Word Free With Regard To Pay Stub Template Word Document Cumed O Word Free Templates Microsoft Word Templates

Hourly Paycheck Calculator Calculate Hourly Pay Adp

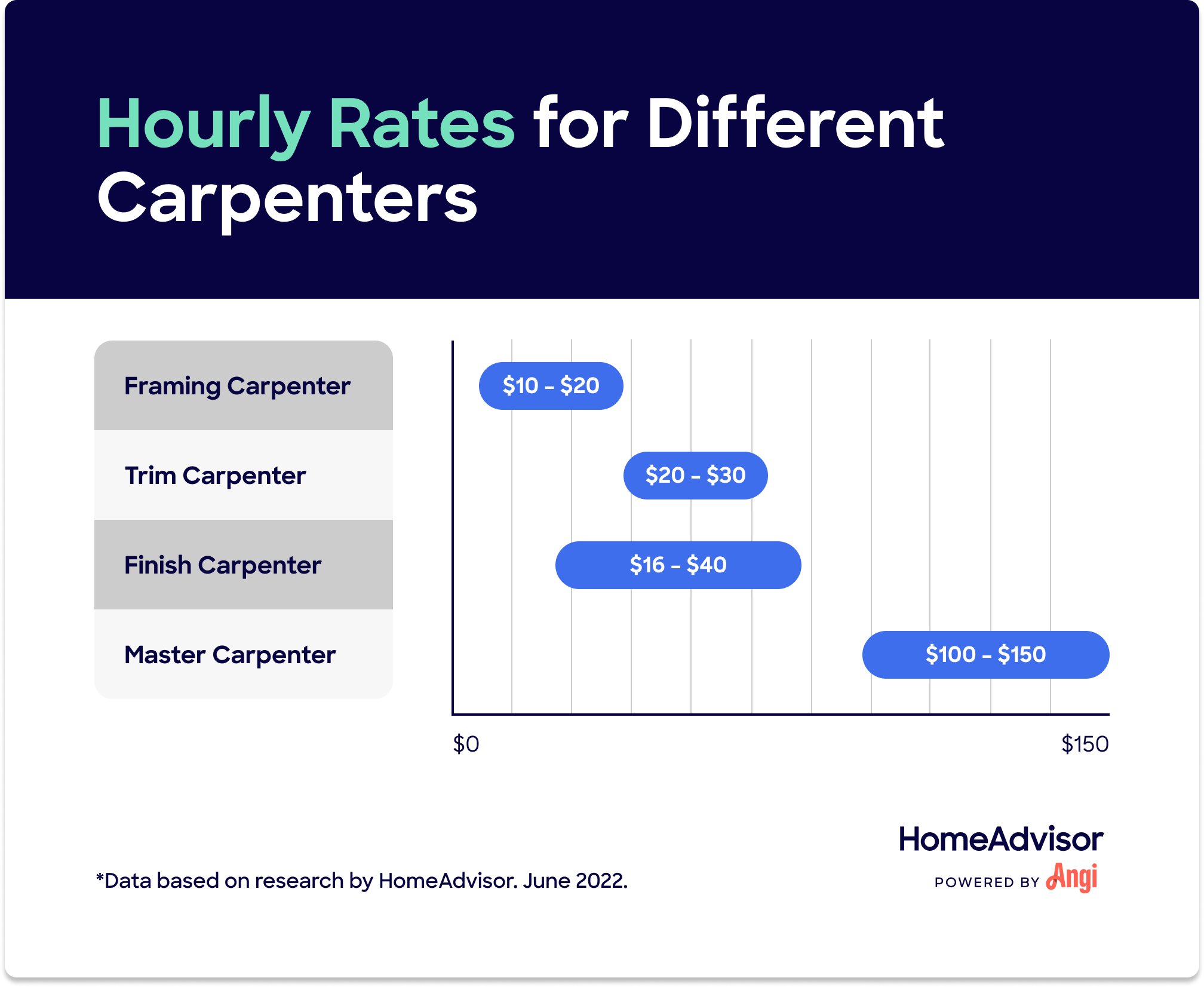

What Are Average Carpenter Hourly Rates